Introduction

![Atea]() Peer Reviews – ITAM Review readers sharing their opinions on ITAM tools, technology and services.

Peer Reviews – ITAM Review readers sharing their opinions on ITAM tools, technology and services.

This review of ATEA Cloud SAM has been written by three ITAM Review readers. Our thanks to Stephen B, K Fowler and Rory Canavan for taking the time to share their views.

Our reviewers have been specially selected for their experience in the IT industry. In the interests of a fair and balanced review our reviewers are new to Atea, i.e. our reviewers are not customers or in any way affiliated with Atea.

ATEA

The Review Panel

![Stephen B, IT Asset Management, USA, Manufacturing, 35,000 Assets]() Stephen B, IT Asset Management, USA, Manufacturing, 35,000 Assets Stephen’s Review of ATEA – Summary

“A cloud based solution for license compliance that is focused on Adobe and Microsoft, but can expand into other publishers with more work”

Strengths

Cloud based, Web browser reporting, managed

Weaknesses

Limited in size/scope, only two specific modules and then its generic SAM |

![K Fowler, ITAM Consultant, UK, Construction and Finance, ~50K employees in last contract]() K Fowler, ITAM Consultant, UK, Construction and Finance, ~50K employees in last contract K. Fowler’s Review of ATEA – Summary

“A well designed, simple to use SAM Service which removes much of the administrative burden of in-house license management tools. ”

Strengths

Ease of use – it will very quickly provide useful information to allow organisations to start realising benefits from their investment.

Weaknesses

It makes it seem too easy, and doesn’t manage some significant (and expensive!) areas of Microsoft Licensing! |

![Rory Canavan, SAM Consultant, UK, IT Consultancy]() Rory Canavan, SAM Consultant, UK, IT Consultancy Rory’s Review of ATEA – Summary

“An entry-level cloud compliance solution.”

Strengths

Its simplicity of use

Weaknesses

Its simplicity of use! Also, it is my belief that the service won’t scale due to the size of inventory files generated |

Ratings

|

Stephen B |

K Fowler |

Rory Canavan |

Total |

| Would you recommend this technology? |

Yes |

Yes |

Yes |

3/3 |

| Would you consider using this technology in the future? |

Yes |

Yes |

Yes |

3/3 |

| Ease of use? (Out of 10) |

8 |

8 |

10 |

8.67 |

| Overall Features (Out of 10) |

7 |

7.5 |

6.5 |

7 |

The Reviews

![Stephen B, IT Asset Management, USA, Manufacturing, 35,000 Assets]()

Stephen B, IT Asset Management, USA, Manufacturing, 35,000 Assets

Stephen

“There is a trend in today’s SAM compliance toolsets. The trend is to focus on the most prominent publishers in the desktop side of IT asset management, Microsoft and Adobe. The Atea Cloud-SAM service is no exception, but with some added benefits and some pitfalls to watch for as well.

At first glance the Atea Cloud-SAM service seems to be just like everyone else. They are focused and have specific modules for Microsoft and Adobe. Behind the scenes, however, it seems like Atea is able to support more than just those two. The path to effectively managing other publishers is not quite as clear, but everything I have seen in the toolset itself says it can be done. This will need further investigation.

Atea claims to support any other publishers a customer could supply contracts and licenses for. This is all well and good, but leaves me wondering how they handle IBM licensing or Oracle licensing. Both of which can be quite complicated and are very prominent in the infrastructure side of businesses today.

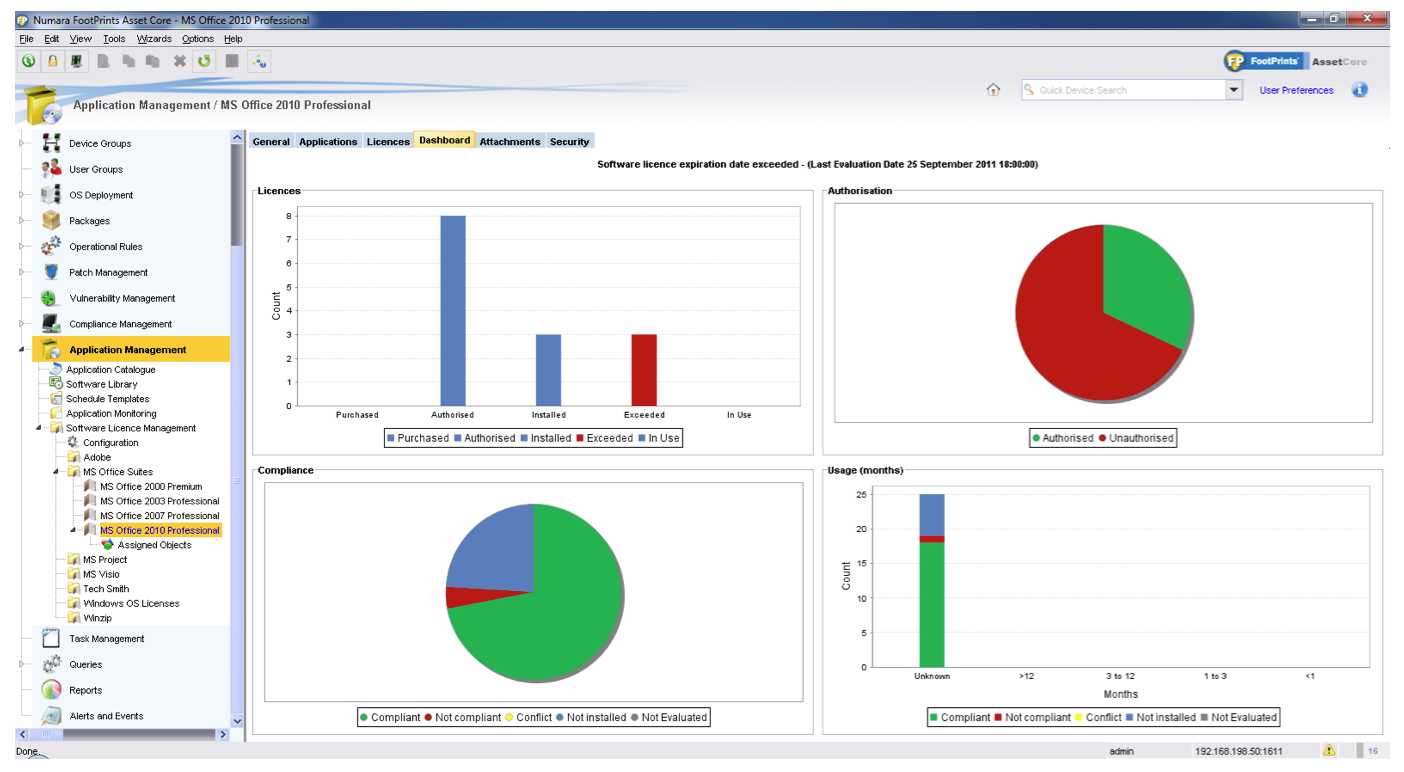

![Microsoft License Compliance Report]()

Click to enlarge

The interface is quite attractive to the eye. It is easy to navigate and understand. There is a potential for a slow system, however, due to the Azure platform it sits on. With proper sizing on Atea’s part, that may never be a factor.

Reporting is good, but could be better. Looking at this from an executive’s standpoint may leave me wanting a more reporting focused view. A reporting portal, separate from the toolset itself would solve this and the appeal of the service itself would get more attention from the powers-that-be.

At the end of the day I think the jury is still out on this offering for anything outside of compliance reporting for either a completely Microsoft business or for desktop and laptop compliance only in a larger company. This is simply due to the lack of dedicated modules handling more of the advanced licensing that infrastructure systems would require. With that said, I have seen where most compliance issues are in the desktop side of most businesses since infrastructure licensing is generally contained better with tighter controls.

If you are looking for a service to help manage your desktop licensing and compliance, and do it in a fashion that you can understand and gain benefit from, Atea should, at least, be on your list of choices. If you are looking to manage more publishers on a large scale, I would still recommend looking at Atea, but other more complex vendors were not within the scope of this review.

![K Fowler, ITAM Consultant, UK, Construction and Finance, ~50K employees in last contract]()

K Fowler, ITAM Consultant, UK, Construction and Finance, ~50K employees in last contract

K Fowler

Atea Cloud SAM provides an easy to use Software Asset Management Service with low barriers to entry, although it is let down by its inability to calculate CAL, Terminal Services and MSDN licensing properly.

I particularly like the option for new customers to use Microsoft’s MAP tool to provide discovery data which will be particularly useful for customers who do not already have a discovery tool in place. Even if MAP doesn’t provide an appropriate solution for the long term, it will allow customers to build a business case for implementing Microsoft System Center or similar product.

The support materials were comprehensive and, if the documented tweaks and fixes are implemented fully, should allow the preparation of a reasonably accurate picture of compliance for Microsoft products, with the exception of Terminal Services licensing which will still need manual input.

This is, of course, assuming that Atea’s documented fixes provide all the information required to apply Microsoft’s complex server and virtualisation licensing rules! Unfortunately this is not something I was able to verify for this review.

Although the emphasis of the Standard Edition is on Microsoft and Adobe licensing and the use of Microsoft MAP or SCCM / System Center as the source of discovered data, Atea state they can use other discovery technologies as well, and can provide compliance reporting for other vendors as well – although this feature is only available with the Cloud SAM Enterprise offering.

Although using Atea Cloud SAM should significantly reduce the administrative overhead of managing in-house license management tools,organisations will still need to put in a significant amount of effort to calculate their own CAL, Terminal Services and MSDN licensing to ensure they are compliant,although Atea has said the ability to identify developer machines is planned for the next release which will make it easier to manage MSDN licenses.

![Atea Cloud SAM Dashboard]()

Click to enlarge

Atea have a comprehensive set of reports available to customers and seem happy to create more upon request.

However Atea claim that using their solution will allow software asset managers to focus on making decisions rather than doing administration. Personally, I think that’s a little disingenuous – although there is no doubt that the Atea Cloud SAM offering significantly reduces the administration associated with managing in-house license management tools, unless there are effective processes in place to ensure both deployment and entitlement are captured accurately and communicated to Atea, the reports that Atea produce will be inaccurate and may lead to poor decision making.

For those customers who are implementing their first software asset management solution, there will still also be the hard work involved of identifying Fully Packaged Product (FPP) and other non-volume licensing entitlement, although generally this will be a one-off activity.

Atea Cloud SAM Enterprise allows organisations to report at business unit level which will be very helpful for larger organisations,although Atea don’t provide any information about whether compliance would be calculated at the business unit or corporate level – or both! Finally, as with all license management tools, usage data is limited by what the underlying discovery tool can provide.

Overall I feel the Atea Cloud SAM Service is best suited to firms with a low SAM maturity level who will appreciate the speed and simplicity of getting up and running with Atea Cloud SAM and the minimum investment required to realise benefits that will help build a business case for more SAM focused activity.

The inability to calculate CAL, Terminal Services and MSDN compliance constitutes a major risk for organisations who use the Service, and as they move up the maturity curve they are likely to find they need to implement an alternative solution which covers these areas.

Overall, the Atea C-SAM Service [Standard Edition] provides a basic entry-level SAM Service. However, as with all tools, you can never escape the age-old principle of ‘garbage in – garbage out’ and it is the customer’s responsibility to ensure that Atea have accurate data to ensure they can provide accurate reports.

![Rory Canavan, SAM Consultant, UK, IT Consultancy]()

Rory Canavan, SAM Consultant, UK, IT Consultancy

Rory Canavan

Atea’s C-SAM offering is very much designed for entry-level penetration into the SAM marketplace. Its service offering has been banded into 3 primary levels:

- Cloud SAM Basic includes software management and software recognition without the license management service;

- Cloud SAM Standard includes full Microsoft and Adobe license management and software recognition;

- Cloud SAM Enterprise includes license management for an unlimited number of vendors. You also receive the additional Cost Saving Report and License Compliance Report for all vendors.

At a glance

The front-end is incredibly straightforward, and allows you to click on the fascia to drill down deeper into the inventory information that is of most interest to you. Your contract position is stated clearly in the top right hand corner of the screen, with an expiry date showing when the contract is due for renewal.

![Software Usage Report]()

Click to enlarge

Speedometer-style displays demonstrate compliance at multiple levels (Vendor, title etc) so an overall balance for compliance can be gained at a glance.

Documentation

The documentation that shipped with this review is fit for purpose, insofar as it describes the technical requirements involved in configuring either using MAP 8 or SCCM for your inventory capture (addressing both 2007 and 2012 versions for the latter). It also highlighted the shortcomings of SCCM when it came to identifying versions and releases of MS Exchange and MS SQL, and the required technical work-rounds that need to take place so that clients are not caught out by versions and editions of Microsoft Software.

One aspect that wasn’t covered in the documentation, was how licence or contract data was incorporated into the solution; many organisations will have a select agreement sitting adjacent to their Enterprise Agreement, and what about those purchases that might have taken place independently of such contracts? Routing around on the Atea website revealed the answer: It is sent to Atea (presumably scanned and then emailed) who then weave it into the client’s compliance picture. Atea also made oblique reference to the software purchasing service they offer, so that if your software is purchased through them, such purchases will instantly be reflected in a customer’s portal.

Whilst the presentation of Microsoft and Adobe data appeared very clean and tidy in the demo , it is not clear how upgrade and downgrade rights are managed.

Also, scoping of licences to cost centres or departments was deemed a consultative “value add” and clients have to ensure that their audit is split to those lines prior to importation.

Atea were candid enough to price their service (for 1000 devices at 48 cents per device, per month) so as a yardstick, 480 euros per month for an SMB would be a reasonable price to essentially outsource your MS & Adobe compliance. However my primary concern in this would be if your IT estate grows, what’s the company limit to which SCCM data can be sent over the internet? I suspect Atea are pragmatic enough to realise that enterprise clients might need bespoke data transmission requirements.

I’m sure too, that Atea are advising their clients that if a device is disposed of, then a routine needs to be established to remove that device from SCCM – otherwise a false licensing position could be reported for machines that SCCM believes are merely “missing”.

Summary

Atea’s offering is a fair entry-level proposition for SMBs who might feel that dealing with software vendors is more than their time is worth; however clients need to be mindful of Product Use Rights that extend “one install requires one license” in the desktop arena, and how software assurance can prolong upgrade and downgrade rights, as well as rights of transfer and in some cases, virtualisation.”

Atea Responds:

![Andreas Hammarskjold – Director of Product Development, Atea]()

Andreas Hammarskjold – Director of Product Development, Atea

“Well firstly I just wanted to say thanks to the reviewers for taking the time and effort to review Cloud SAM. As it’s a relatively new service for Atea in terms of the foray into Cloud-land, it’s been great to get some feedback from fellow SAM professionals. Since its launch back in 2012 Cloud SAM is now helping to manage well over 250,000 endpoints. Most of those customers support between 2 and 25,000 users, with an un-surprisingly diverse array of licensing types from many Software vendors.

Within the Nordic region, Atea has been supplying software and services for many years, and within these services, Software License Management has grown into a major part of the business. In fact Cloud SAM itself grew out of our Compliance Manager product which is the on-premise version of our License Management solution. Our SRS team is based in Riga, and to date has amassed a database of well over 200,000 software items from which they can provide a fast and efficient license compliance and management service. Many of our Cloud SAM customers purchase their software through the Atea e-shop portal which obviously makes life easier as we can track each license from day one. Other customers deliver their license data to us in a variety of formats. Email, spreadsheet, PDF or even a drawer full of paper receipts can all be integrated by our SAM team. This is where the Cloud SAM service comes into its own, with each customer assigned a SAM specialist who can work with the internal SAM resource on any custom reporting requirements or licensing issues.

The review was based on the Standard version of Cloud SAM (there are three), which is obviously biased towards Microsoft and Adobe licensing. This gives you a fairly good taste of the interface and day to day capabilities of Cloud SAM, but most of our customers tend to move to the Enterprise subscription once they get to grips with the service, as this is a much more comprehensive offering, where we can work with the customer on the more complex licensing types such as the IBM/Oracle models mentioned in the review. It’s also worth mentioning I think, that we have quite a few customers who utilize Systems Management software other than the supported Microsoft System Center Configuration Manager and/or MAP solutions. So long as it’s a database and contains the necessary data we can work with it, although you don’t get the same level of sophistication. For example Cloud SAM uses filters and queries to leverage the SCCM heartbeat functionality that helps us to understand whether a device is alive or off etc.

We have lots of exciting new developments in the pipeline for Cloud SAM, including a much expanded Server licensing capability, so hopefully we can check back with the reviewers in a few months for an update.”

Andreas Hammarskjold – Director of Product Development, Atea

Further information:

This review has been written by three ITAM Review readers. Thank you to Stephen B, K Fowler and Rory Canavan for taking the time to share their views on the Atea Cloud SAM. This is a paid review. Reviewers have been paid for their time. For full details please read our Disclosure Statements. To learn more about our Peer Reviews or to become a reviewer please contact us.

The list below are what I call ‘Competitive Differentiators’. They are strong features that are unique to certain SAM tool manufacturers. Once the majority of tools on the market offer these features they will no longer be considered differentiators.

The list below are what I call ‘Competitive Differentiators’. They are strong features that are unique to certain SAM tool manufacturers. Once the majority of tools on the market offer these features they will no longer be considered differentiators.

First of all, it should be noted that 1E doesn’t offer an all-round traditional SAM tool. You could quite easily compliment all of the other SAM tools in this review with what 1E have to offer. The company has a different approach to most SAM vendors and their tools in that it doesn’t offer a comprehensive multi-territory license ledger as such, but I wanted to include 1E in the 2012 SAM tools review to recognise their innovation and unique approach to managing software efficiency.

First of all, it should be noted that 1E doesn’t offer an all-round traditional SAM tool. You could quite easily compliment all of the other SAM tools in this review with what 1E have to offer. The company has a different approach to most SAM vendors and their tools in that it doesn’t offer a comprehensive multi-territory license ledger as such, but I wanted to include 1E in the 2012 SAM tools review to recognise their innovation and unique approach to managing software efficiency.

Independent Review

Independent Review

Introduction

Introduction

Peer Reviews – ITAM Review readers sharing their opinions on ITAM tools, technology and services.

Peer Reviews – ITAM Review readers sharing their opinions on ITAM tools, technology and services.